Investing in Equity Around Your Constraints

A compass for investors drawn from navigating the markets

When we're in an unfamiliar town, we often turn to the locals for directions instead of figuring it out ourselves. Sure, with trial and error, we could eventually reach our destination. But locals have something we don’t — a mental map shaped by years of walking, driving, and navigating those very streets. They know the shortcuts, the traffic-prone areas, and the dead ends. And most of us would rather reach where we want, than meander through trial and error.

In the same way, the framework I’m sharing here is an abstraction, a map constructed from my experiences (of being an investor and now being an advisor to others). You can reach your financial destination on your own, but a map might help you get there with confidence, without the twists and turns I had to take.

Among the seven asset classes that one can invest in, equity is essential in any portfolio. It is one of the most accessible ways for long-term wealth creation. So the question is not if one should invest in equity, but how. And the first step is figuring out a style that matches your strengths.

This piece is an important one, best digested with tea and time.

Orienting Yourself

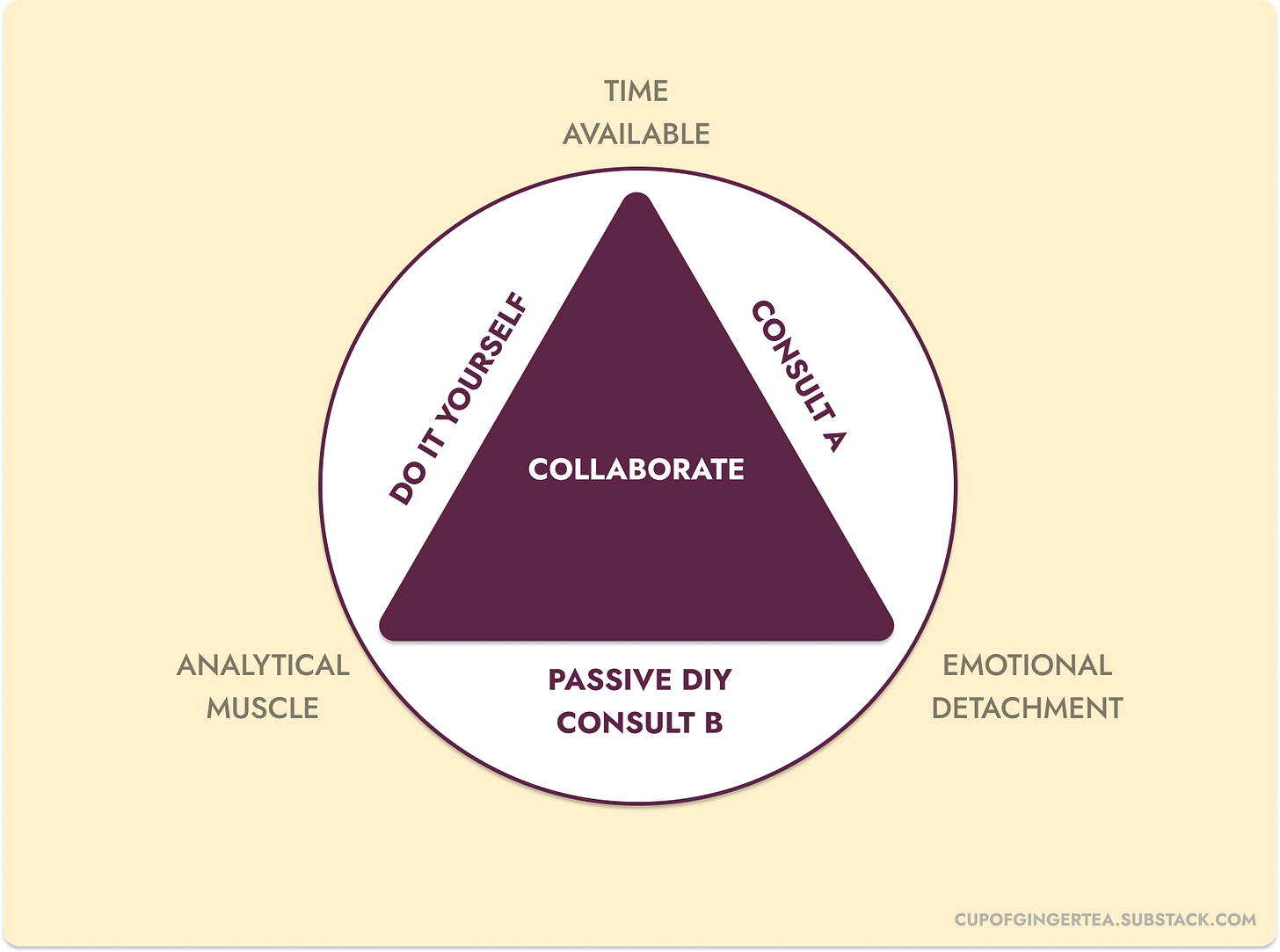

Just like reading a map requires knowing where you are and which way is north, figuring out your investing style begins with a little self-orientation. Instead of the four compass directions, we’re guided by three personal traits.

🕰️ Time Available: The most limited resource. How much time can you realistically set aside to read the news, monitor markets, and manage your investments? Some styles demand attention; others let you set a course and check in occasionally.

⚖️ Emotional Detachment: How closely are you tied to the ups and downs of your money? Do you feel the urge to react to every market dip, or can you take a step back and let things play out? This trait shapes how hands-on or hands-off, you can afford to be.

📈 Analytical Muscle: Do you enjoy digging into data, spotting patterns, and staying updated on market movements? Or does that sound more like a chore than genuine curiosity? Your comfort with analysis plays a big role in choosing an approach that won’t feel like “work”.

These traits don’t exist in neat boxes, they lie on a spectrum. You might have a bit of analytical curiosity, a moderate amount of time, and a tinge of emotional detachment. The key is to understand which of these traits are most dominant for you. That awareness becomes your compass, guiding you choose a path that plays to your strengths.

In the next part, we’ll look at the different equity investing styles based on these traits.

Style 1: Do-It-Yourself

DIY investors are typically curious about financial markets, have a strong grasp of macroeconomics and enjoy actively managing their portfolios. In addition, they have the analytical capability to scale their strategies as their net worth grows.

This style is demanding, but the reward lies in the speed and autonomy, the DIY investor becomes the sculptor of their success. The satisfaction of one’s views being validated (when they’re right) can be rewarding and addictive too. Unlike fund managers of mutual funds who are constrained by flows, mandates and investment themes, DIY investors can choose what they believe in and bet their money on that decision.

While this style can be deeply educational, it comes with the risk of being equally responsible for losses sustained. If these losses are substantial it can make the financial journey harder to navigate. This affects not just the portfolio returns but the individual morale as well.

DIY investors enjoy autonomy and control in directing their financial journey. However it is because of this very trait that they struggle to emotionally detach from their investments. When you’ve put in time, thought and effort into an investment, letting go becomes personal and emotionally draining.

Emotional detachment is necessary because it reduces biases. And biases, for a solo investor are a bit like Schrodinger’s cat, simultaneously present and absent until you try to observe them, when they promptly change shape. The investor may believe that they don’t have biases just as one can believe that the cat is alive or dead when the box is closed. Recognizing that biases are present, even if they aren’t visible in the mirror, is the first step to managing them.

Perhaps, the hardest skill for a DIY investor to master is doing nothing. Studies1 show that in many situations, the least intervention can get the best results. But for a DIY investor who enjoys being in the driver’s seat, the bias to action is a constant battle. It’s easy to slip into a cycle of overdoing and overanalyzing that is counter productive for long term returns — as evidenced from the initial parts of my journey. [link]

Style 2: Consult

Building wealth does not require you to become a financial expert just as staying healthy does not require you to be a doctor. In areas outside our expertise, we hire the experts: doctors, lawyers, therapists and investing is no different.

Consulting is for those who understand the power of compounding and recognize the importance of having equity in their portfolio—but do not wish to do it themselves.

Consult A is for someone who has the time but lacks the analytical ability to confidently manage investments.

Consult B is the reverse: the investor has strong analytical muscle but simply no time to apply it.

Consulting also suits those who lack both Time and Analytical Muscle. What they do have is Emotional Detachment, a critical trait when delegating decisions. These investors are thoughtful about evaluating advisors. They look for sound processes, clear communication, and alignment with long-term wealth-building. Once they choose their advisor, they use their expertise to the fullest. The biggest value a good advisor adds often isn’t superior returns—it’s behavioural discipline.2

Benjamin Graham famously said, “The investor's chief problem, and even his worst enemy, is likely to be himself”.

When decisions are outsourced to a qualified advisor it significantly reduces the likelihood of personal biases negatively affecting one’s journey. But this benefit holds only if the advisor questions rather than only echoes the investor’s views. Therein lies the challenge of the consulting style — having the right perspective to differentiate a good advisor from a bad one is not easy. (This requires a bit more detail which I’ll explore in a future essay.)

It is important to be cautious when selecting an advisor, but that caution shouldn’t delay action. As anyone who understands compounding knows, the key is to start now, rather than later.

Style 3: Passive DIY

Passive DIY investors have good Analytical capacity as DIY investors but lack Time. Additionally, they lack access to a reliable advisor or prefer not to work with one.

A Passive DIY investor has to take care of a few key decisions,

Ensure the portfolio is asset-allocated (link)

With asset classes which are uncorrelated (link)

And set up SIPs (Systematic Investment Plans) to low-cost Index mutual funds that track market indices

While Index/Passive funds may not offer the same potential for high returns as direct stocks or actively managed funds, they also carry lower downside risk as they simply mirror the index.

By removing the need to choose between specific companies, sectors or timing the market, investors also remove a lot of subjectivity and biases. The decision making is outsourced to the market index itself making this extremely simple and objective. Another key benefit between being a DIY investor versus a Passive DIY investor is that you are not alone in facing market volatility. When there is a downturn and the Nifty 50 goes down 10%, your portfolio being made up of the same index would have a similar impact.

With this style emotional detachment is an advantage as well as the toughest one to practise. Passive investing requires one to follow the emotionally difficult path of choosing a strategy and sticking to it no matter what.

Style 4: Collaborate

The collaborative investing style is about actively co-creating one’s financial journey with a trusted advisor or partner. It involves participation, dialogue and shared decision making to achieve a common goal.

It demands all three traits:

Time, to keep oneself updated on the macro trends

Analytical muscle, to evaluate options and debate perspectives

Emotional detachment, to stay open to alternative views

A major strength of this approach is its potential to counteract personal biases, thanks to the presence of a knowledgeable sparring partner, to validate hypotheses, bounce off ideas and have fun. By working alongside someone equally or more experienced, investors often benefit from faster learning, fewer errors, and quicker feedback loops. It creates an environment that builds resilient systems over being only result driven.

Most investors do not have this luxury. Investment conversations, when they happen, are often fleeting and focused on a trending stock or a hot strategy. Talking about money often feels too personal, even intrusive—like peeling back a layer most people would rather keep private. There’s a fear of being judged, of revealing too much or of seeming uninformed. Mistakes that only we know of are easier to digest; the same mistakes sting a lot more when witnessed by others. As a result, many end up navigating their financial path in isolation, without the benefit of sounding boards or alternative perspectives.

This style of investing sits in the middle of our triangle, balanced across traits. It requires openness to different perspectives, the wisdom to know when to trust one’s own judgement and when to defer to the advisor/partner. This being a hand-ons style, alignment of values and principles between the investor and the collaborator is crucial for long-term success.

Even with one Trait, Begin.

The framework I’ve shared assumes that investors identify with two dominant traits out of the three. But what if you find just one trait that clearly stands out?

🕒 Time is your strength

You have something most people yearn for. That’s a powerful asset and it opens the door to two possibilities

Spend time building your analytical muscle and ease into Passive DIY investing.

Use the time to find a trusted advisor to achieve your goals.

Either way, time gives you the breathing room to deliberate and choose.

⚖️Emotional detachment is your strength

You do not feel the itch to check your portfolio every other day. You have neither the time nor the inclination to do so. You’re happy to take the back seat and let your investments compound while you focus on what’s important to you. The calm detachment is rare, invaluable and makes your path clear, partner with someone you can trust

📈Analytical capacity is your strength

You love immersing yourself in the financial markets as well as being in control of your portfolio. However when time is in short supply, you risk half-built strategies. The solution is to carve out a small portion of your portfolio (typically less than 20%) and experiment your bets there. The remaining portion of your portfolio can follow a more hands-off approach using a passive investing style or guided by an advisor.

Start With Who You Are

Knowing the difference between what you're capable of doing vs. what you want to do, will give you the clarity to make decisions.

You might recognize several traits in yourself, but only a few may feel right to apply when it comes to managing your wealth. For example, your analytical skills that you use at work may be strong but you might prefer not to use them for your investments.

I’ve put together a simple flowchart to identify the investing style that matches your preference. Answer the questions and see where you land.

Start From Where You Stand

Understanding where you stand helps you find an investment style that fits you, aligns with your strengths and is sustainable. Like with most things in life, your dominant traits may evolve and so should your investing style. I started as a DIY investor, moved toward passive investing when time was short and now find comfort in a collaborative style, something I write about here.

If you do not know your starting point, the most detailed map and the clearest of directions will lead you through sub-optimal paths to unintended destinations. So take a moment to orient yourself. Choose the style that fits your current reality, not the ideal version of reality in your imagination. Because most of us don’t get to stumble our way into wealth, we need to navigate toward it.

Whichever investing style you identify with, I wish you the best in your journey.

If the Consulting Style resonates with you or if you're unsure which investing style fits you best, let’s discuss. Drop me a note at malarkodi@quinstinct.com or complete the form below (5 questions) with your context.

I will respond to you within 3 days. Should your situation align with my expertise, I’ll send a link for us to meet online. This is a no obligation meeting on either side.

Read more about me here, and for disclaimers see here.

The 1999 study titled The Courage of Misguided Convictions shows that the least active investors had an annual portfolio return of 18.5% while the most active investors had an annual portfolio return of 11.4%

The 2013 white paper by Morningstar titled Alpha, Beta, and Now…Gamma argues that a financial advisor's role extends beyond traditional investment management (alpha and beta) to encompass "Gamma," which quantifies the additional value from intelligent financial planning decisions for clients.