It was 9 p.m. on a cozy November night in 2020. I sat at my desk, a steaming cup of tea in one hand, the other scrolling through an excel spreadsheet. Over the past month, I had meticulously built this file: ten years of ITC’s financial data, with the P&L, Balance Sheet, and Cash Flow nestled in their own tabs.

No matter how much I poked and prodded, the insight from the data was clear, the company’s financial performance over the past decade was solid1. The next day I acted, I invested in ITC at ₹187 per share.

This analysis, sprinkled between late nights and weekends, took me about a month. Once the excitement of the decision faded, life’s priorities took up my attention. I got busy and did not make any new investments.

Two years later, the price of ITC had shot up to ₹347 per share—an annualized return of 37%. My investment had doubled in just two years, outpacing the market return of 19% (Nifty 50) during the same period.

Wow Malar, that’s some brilliant stock picking. Pat-on-the-back.

Not so fast. Despite this impressive 37% return on ITC, my overall return had barely moved—it had only inched up from 8% to 9%.

Wait. What?!?

I had invested too little, just 4% of my money into ITC. The rest of my2 portfolio—the much larger chunk—was sitting in Fixed Deposits (FDs), Recurring Deposits (RDs) and PF (Provident Fund) accounts. All of these were fixed-income3 products which were giving me 7-8% annual returns.

ITC’s stellar performance was just not enough to make a dent on my overall return when it occupied such a tiny share in my portfolio. Stewing over this realization, I simmered with the possibilities of what could have been…

“I should have invested 10x the amount into ITC.”

Sure, investing 40% of my money here would have increased my total return, but even the most aggressive stock market investors would not advise putting that much into a single stock, no matter how good the prospects are. Concentrating so heavily on one company is a gamble, not a strategy.

“I should have invested in 10 more stocks like this.”

Diversifying across 10 companies with growth potential seems like a good way to improve overall returns, in theory. Then, there is reality where finding such companies takes time, effort and diligent research. Even after all that, there is no guarantee that all of them would perform well—some might barely break even or worse lose money. Getting a 37% return for all 10? That’s an ambitious stretch.

“I should have picked a better stock, something that gave 100% returns.”

Now, that’s just wishful thinking. It is easy to dream of perfect decisions, but the stock market doesn’t reward fantasy.

Zooming out: A more rational voice said that all I was coming up with, were hindsight solutions. They focused on improving that tiny 4% while ignoring the 96% that was dragging my overall returns. It was like trying to outrun a bad diet (which I honestly thought I could do in my 20s but that’s for another essay). I didn’t need sky-high returns on the 4%, all I needed was good returns on my 100%. I had to zoom out and look at my entire portfolio if I wanted to avoid an epiphany like this in another two years—reflecting on missed opportunities.

First, Design the Blueprint

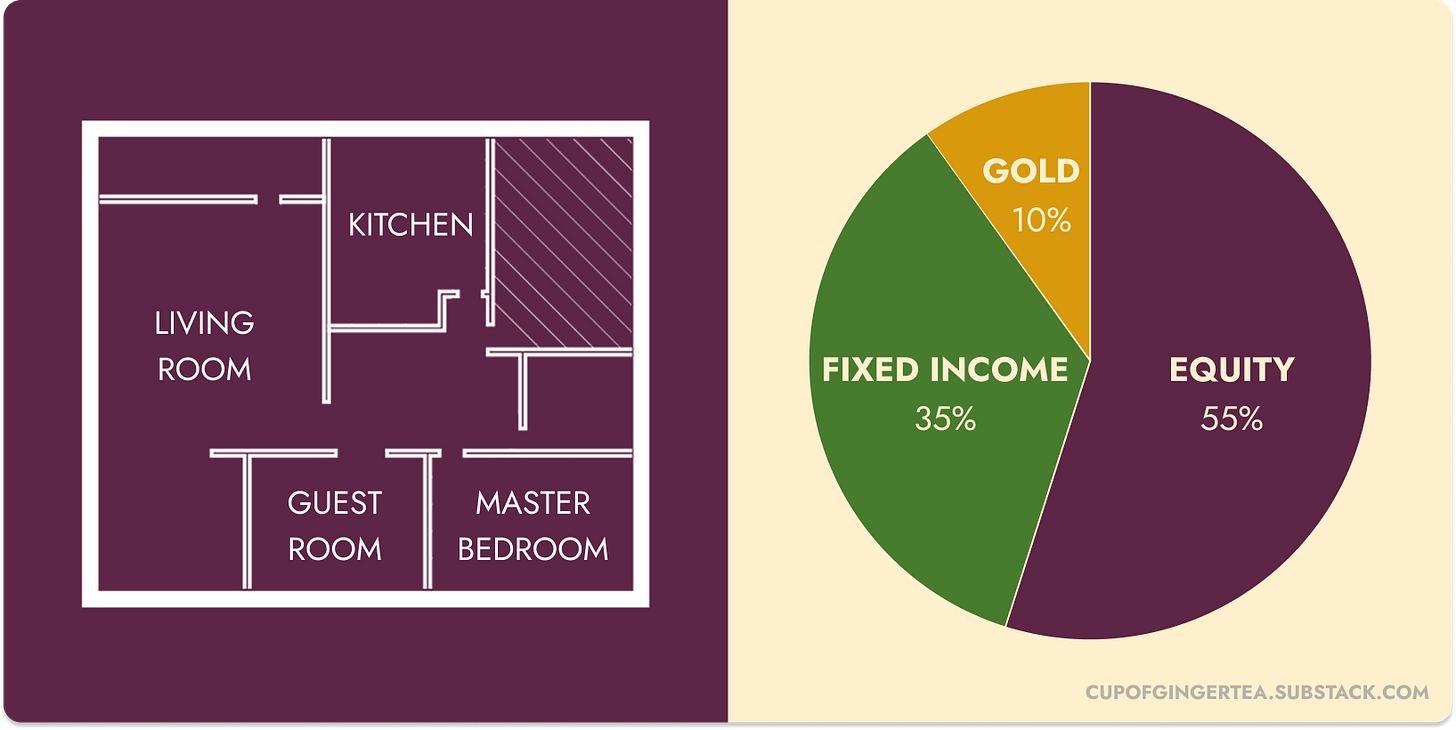

Imagine you're standing on the empty plot of land where your dream house will someday rise. Planning it is an enormous task with many interconnected decisions, where do you start?

Even if you have never touched an architect’s pencil, your instincts know: before choosing paint colors or door handles, you decide the big things first — the design, the structure, the flow. How many rooms? How big? Where will the sunlight come in?

Why then was I doing the opposite with my investments? I had spent an inordinate amount of time analyzing and picking a single stock without considering my portfolio as a whole. I was obsessing over which sofa to get for my living room before I even designed the blueprint of my house!

The real limiter wasn’t my stock-picking skills. It was my asset allocation.

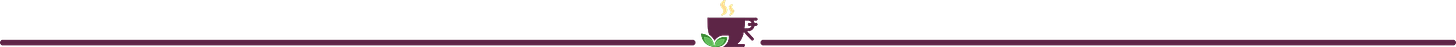

Asset allocation means deciding how much of your money goes into different asset classes4. Designing a portfolio follows a similar logic to designing a house: it begins with the big decisions first.

Decision 1: How Many Rooms Do You Need?

Think of each asset class—equity5, fixed income, real estate, commodities (gold, silver)—as rooms in your portfolio.

The simplest version of asset allocation requires just two types of asset classes. An asset class which is risky but will give you higher returns in the long-term—Equity. The second asset class which is less risky and gives lower but stable returns in the short and long term—Fixed Income.

Decision 2: How Big Should Each Room Be?

Having chosen the asset classes you want to invest in, next is to determine their size in your portfolio. There’s no one-size-fits-all mix of equity and fixed income. The allocation you should have, will depend on your relationship with risk, your personal circumstances, and, importantly, the price at which you're able to invest in these assets.

Answering this question deserves a deeper look, which I’ll explore in a future essay.

Decision 3: How To Furnish Each Room?

What remains is to choose which products to invest in for each asset class. For equity, this would involve selecting stocks, mutual funds, or ETFs. For fixed income, it would mean choosing bonds, fixed deposits, or debt mutual funds.

Before All Else: Get The Order Right

Asset allocation, done thoughtfully, will improve portfolio returns over the long term while also reducing portfolio risk. In 1986 a study by Brinson and Beebower6 found that asset allocation is the primary factor influencing 80-90% of the variability in portfolio returns. Follow-up studies7 offer more nuanced perspectives, but the core principle remains: Allocation matters.

In investing, it’s tempting to focus on the next big opportunity—the perfect stock, the top-performing mutual fund, or the latest tax-free scheme. While these are not inherently harmful, the sequence of decisions is critical. Prioritize getting the strategic decision of asset allocation right, before being swept away by the volume of tactical choices.

Strategic before Tactical. Blueprint before Furniture. Asset Allocation before all else.

If you are considering a review of your portfolio’s asset allocation and would like my opinion, drop me a note at malarkodi@quinstinct.com or share your context in the form below (5 questions).

I will respond to you within 3 days. Should your situation align with my expertise, I’ll send a link for us to meet online. This is a no obligation meeting on either side. Read more about me here, and for disclaimers see here.

This is not a recommendation to buy ITC. This was my opinion of this company when I analyzed it in 2020.

When I say “my” portfolio, it means all of mine and husbands’ money. I’ve been his unofficial financial planner before I got certified to be an actual one.

Fixed income is a broad asset class that includes bank deposits, PPF, EPF, government bonds, corporate bonds, and asset-backed securities. It is called 'fixed income' because these assets provide a return in the form of fixed periodic payments. Source

An asset class is a grouping of investments that exhibit similar characteristics and are subject to the same laws and regulations. Asset classes are thus made up of instruments that often behave similarly to one another in the marketplace. Source